How Fin Capital Identified 30% of All Subscriptions as Duplicates with Stackpack

See how this global asset manager uses Stackpack to centralize vendor data, cut duplicate subscriptions, and boost stakeholder trust with effective spend intelligence.

- ~$5K saved by eliminating duplicate vendors

- 30% of all subscriptions identified as duplicate or underutilized

- ~50 hours saved annually answering subscription-related inquiries

- Over 20 hours saved on annual payment reconciliation

“We were spending hours hunting through 50-page contracts just to figure out renewal dates. Stackpack solved that in two hours. Partnering with them was a no-brainer.” – Susan Liang, Director of Finance at Fin Capital

About

Fin Capital is a global asset manager headquartered in San Francisco. Founded in 2018, they invest in full-lifecycle B2B fintech software companies, providing close, hands-on support for innovative founders. Their portfolio spans 150+ investments, including industry leaders like Bilt, Axio, and Hummingbird.

Note: Stackpack is not part of Fin Capital’s portfolio.

The Problem

"We saw many unexpected charges in our credit card statements because employees subscribed to one-off tools without telling anyone. We wanted to evaluate which subscriptions were actually helpful for the firm and which ones we should remove."

Ad Hoc Subscriptions Created Blind Spots in Company Spend

A leading investor in B2B fintech software, Fin Capital had been steadily expanding their reach and continuously supporting fundraising efforts. As momentum built, maintaining strong cash flow became a top priority for Susan Liang, Director of Finance. Managing the company's vendors was central to this effort.

To enhance their workflows, employees signed up for new platforms ad hoc, without looping in finance for oversight. These tools boosted individual users' day-to-day productivity. Yet, without a centralized view, Susan couldn’t answer key questions, like which subscriptions were active, how much they cost, who had access, and what value they delivered for the business.

“We need these details to remove duplicate vendors and unused subscriptions that auto-renew, without our knowledge,” explains Susan. “That way, we can manage our resources effectively and position ourselves to deliver value to investors and our portfolio companies.”

The situation became even more complex when an employee left and access credentials left with them. Ongoing charges continued to accrue, calling for manual intervention. And with little clarity on account ownership, Susan and her team needed to double down on monitoring for potential security risks.

To gain visibility, Fin Capital built a spreadsheet that listed some subscriptions and contract information. However, this system captured only enterprise-level tools, missing individual subscriptions that employees had signed up for personal use and experimentation.

Plus, to keep it up to date, the team would manually hunt through 50-page contracts, extract key terms, and update records. This process worked for a while. But hours spent gathering and analyzing data meant less time for key internal initiatives. Critical priorities like optimizing Fin Capital’s budget and producing performance reports to support fundraising efforts took a back seat.

Determined to find a better way, Susan and her team started looking for a solution that would provide a clear, real-time overview of their vendor landscape with minimal manual input. They explored several promising tools, but none offered the deep subscription-specific functionality Fin Capital required.

Everything changed when Susan discovered Stackpack. After just one demo, she was convinced that the platform’s spend intelligence and contract management were exactly what she needed to optimize spend and reclaim lost time.

The Solution

Stackpack Delivers Real-Time Vendor Visibility with AI-Powered Automation

In Susan’s words, integrating Stackpack felt like “flipping a switch.” Within two hours, the platform had connected to Fin Capital’s QuickBooks Online account to access all vendor data - even one-off, hard-to-track subscriptions.

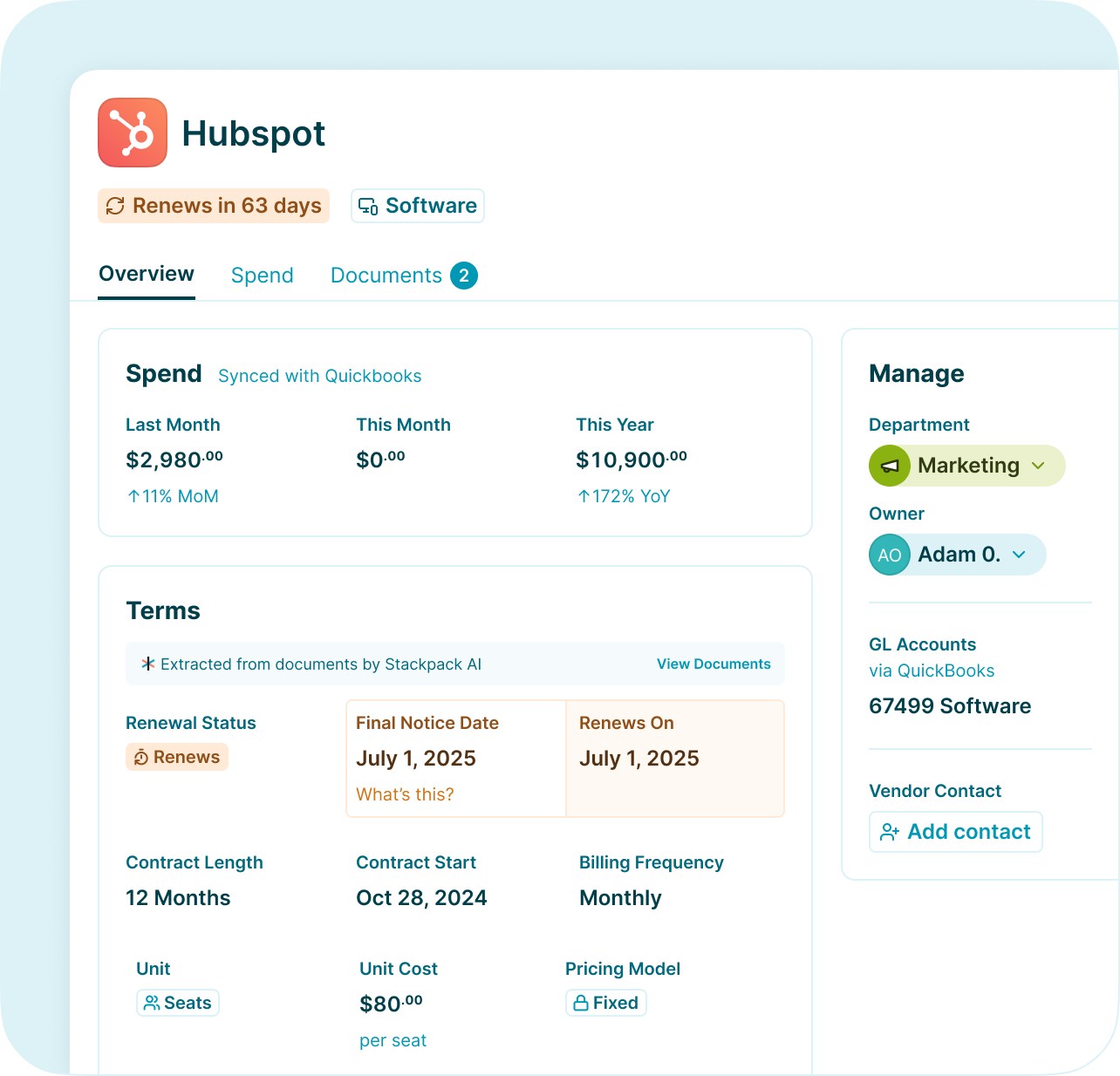

Using this data, the platform’s AI Assistant extracts key contract details, like renewal terms and pricing details, and populates them in Fin Capital’s intuitive dashboard. This view shows all vendors by type, allowing Susan to identify duplicate spend and unused subscriptions at a glance. Armed with this data, Susan makes swift decisions about cutting vendor costs and renegotiating contracts, unlocking thousands of dollars in potential savings on the spot.

Stackpack also ingests invoices - an unexpected bonus - allowing Susan to track ad hoc project expenses not detailed in original agreements. She now compares contracted spend with actual payments, giving leadership and investors a complete picture of Fin Capital’s cash flow. In turn, the data boosts trust and confidence in the firm’s trajectory and financial performance.

This entire setup runs 24/7 with minimal input from Susan’s team, saving valuable time for high-impact work. Instead of sifting through documents and updating spreadsheets, they have real-time visibility on demand. If a contract needs attention - like an upcoming renewal - Stackpack sends automated alerts via Slack and email, supporting timely action. The platform even flags transactions with new vendors, so the team can upload the corresponding contract.

Beyond this intelligent vendor management, Susan uses Stackpack's AI chat feature to query data on demand. For example, she asks questions like, “How much are we paying for Zoom this year versus last?” and receives instant, actionable answers. The result is faster, data-driven spend decisions that demonstrate operational discipline to potential investors.

What sets Stackpack apart for Susan, though, isn't just the technology - it's the team behind it. Thanks to regular check-ins and a nimble, responsive approach, they stay aligned with Fin Capital’s priorities and consistently make adjustments to ensure the platform delivers maximum value.

“The moment we connected our systems on Stackpack, information started flowing in. We now have a single source of truth for our subscriptions, so we can drill into our spend and figure out which platforms are truly beneficial for our business.”

The Outcome

Fin Capital Saves 50 Hours on Subscription-Related Queries with Stackpack

Through Stackpack’s automated vendor tracking and contract management, Fin Capital transformed their software subscription management. Susan and her team now have the real-time financial visibility needed to optimize vendor costs, monitor cash flow, and build investor trust — all while saving hours of manual work each month.

- ~$5K saved by eliminating duplicate vendors

- 30% of all subscriptions identified as duplicate or underutilized

- ~50 hours saved annually answering subscription-related inquiries

- Over 20 hours saved on annual payment reconciliation

Moving forward, Fin Capital is excited to see how Stackpack will continue to deliver even more value for their business. Susan is particularly eager to use two upcoming features - advanced AI tools and vendor pricing benchmarks - to uncover even deeper cost optimization insights.

Cut Duplicate Subscriptions. Save Thousands.

See how Fin Capital uncovered 30% of their SaaS tools as duplicates or underused — and saved $5K in the process. Stackpack gives you instant vendor visibility, automated contract tracking, and real-time spend insights to take control of your software budget.