Autopilot Consolidates Multi-System Vendor Data and Saves 200+ Hours A Year with Stackpack

Learn how Autopilot consolidated vendor tracking and gained instant spend visibility, eliminating manual spreadsheet work.

- 90+ hours saved annually on vendor reporting

- $13,000+ worth of finance hours reclaimed each year

- ~2x annual ROI, with each dollar delivering $2 in finance time savings

About Autopilot

Autopilot is a fintech platform that lets users automatically mirror trades made by top investors and public figures through their own brokerage accounts. Since launching in 2023, it has facilitated over $2 billion in trades and raised $7 million from investors, including Craft Ventures, Nomad, Path Ventures, and Balaji Ventures. Its rapid growth earned it the nickname “the Pelosi app” and recognition as one of the fastest-growing registered investment advisors in the U.S.

The Problem

"Every question about vendor spend meant diving into spreadsheets for two to three hours. As a fast-growing company, cash visibility is too important for that kind of manual work."

Vendor Visibility Gaps Risked Derailing Hyper-growth Plans

As the Financial Controller steering Autopilot through hypergrowth, Glenn Solan managed an increasingly complex vendor ecosystem spanning multiple payment channels. The company's distributed leadership model - with four founders each driving their functions - created a dynamic environment where vendor relationships multiplied rapidly across different credit cards, bank accounts, and payment methods.

Glenn had developed a sophisticated manual tracking system to maintain control. For example, when leadership asked about Meta spending, Glenn's process was painstaking. First, he logged into Brex to pull credit card transactions, then searched QuickBooks for direct invoices, and then checked Bill.com for scheduled payments. Compiling everything into spreadsheets, manually categorizing, and reconciling duplicate entries consumed two to three hours per vendor query - and Glenn often fielded multiple requests monthly.

The stakes were high. As Glenn explained, "Cash is important, and the amount of cash that we spend is a big topic every month." With Autopilot pursuing 100% year-over-year growth, complete visibility into cash burn and spend were critical. Understanding spend patterns - along with the ability to report this quickly and accurately - was essential for financial oversight and avoiding overspending.

The company’s hypergrowth also increased financial complexity across the board. Fragmented vendor data and manual reporting often slowed insights and delayed decision-making precisely when speed mattered most. Glenn needed to track and manage cash burn to respond to shifting financial needs in real-time. It was clear Autopilot required a solution that could simplify and unify vendor tracking, giving decision-makers instant access to reliable financial data as they scaled.

When Glenn discovered Stackpack, the platform's ability to provide complete visibility and control over vendor spend made it the exact solution Autopilot needed at this critical growth stage.

The Solution

Real-Time Vendor Spend Visibility Across All Payment Channels

During onboarding, Stackpack's support team proved exceptional when setting up and configuring Autopilot's data. Glenn connected Stackpack to Autopilot's financial infrastructure, including QuickBooks, Bill.com, and Brex. The platform’s intelligent data extraction consolidated data from multiple channels, delivering the unified vendor view Glenn needed.

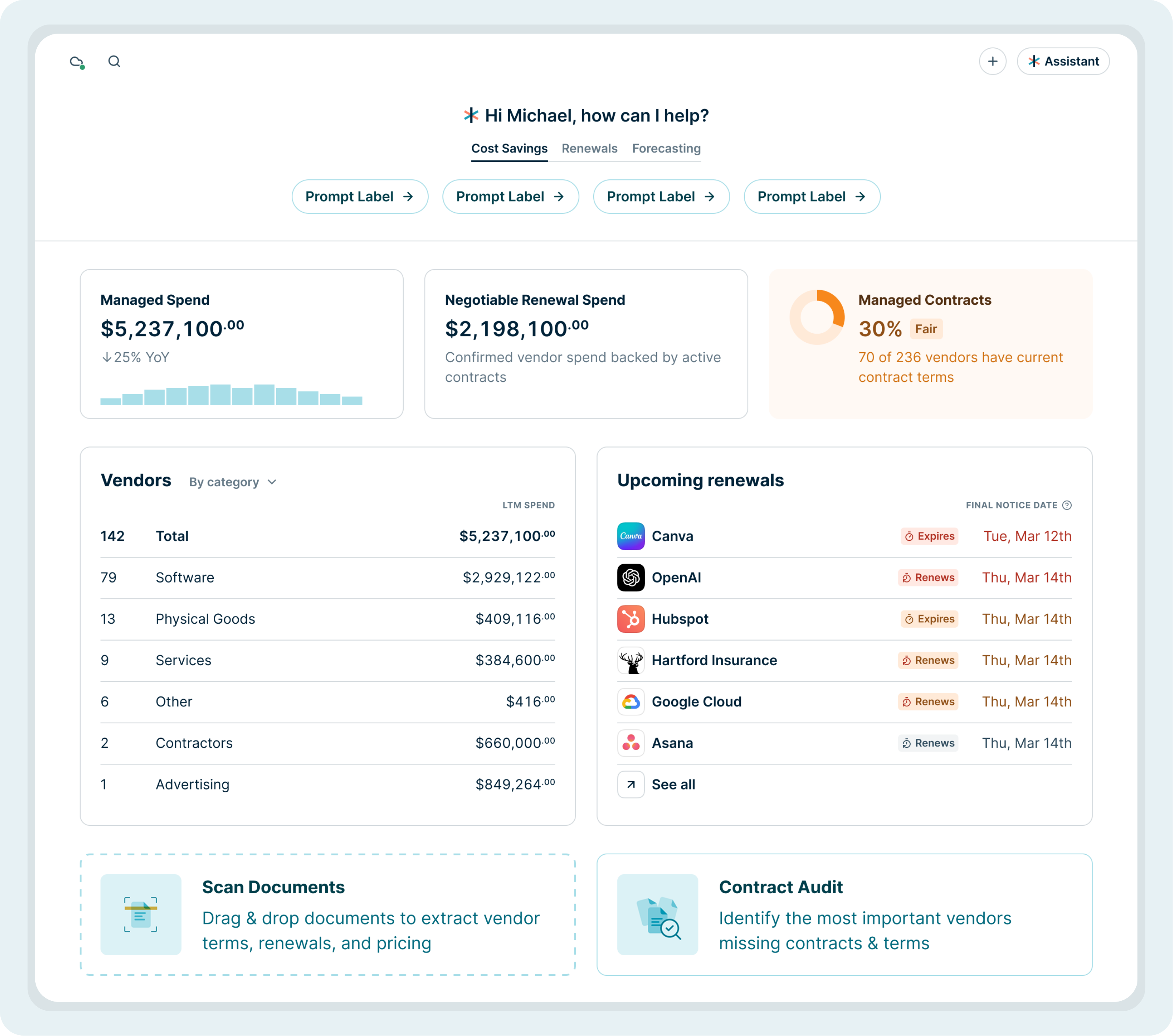

By centralizing vendor management in a single source of truth, Stackpack turned Autopilot's vendor sprawl from an operational risk into a strategic advantage. The platform’s AI automatically enriches vendor data with descriptions and categories, then gives Glenn a simple interface to assign department ownership — eliminating the need for manual spreadsheet tracking. Real-time spend visibility replaced Glenn’s multi-system reconciliation process, giving him instant access to every vendor expense through automated categorization and live dashboards.

Today, the platform is Glenn's go-to tool for his most critical workflows.

First, answering ad-hoc vendor questions from leadership is effortless. Questions that previously sent Glenn diving into spreadsheets for hours now had instant answers through Stackpack’s comprehensive spend analytics. When leadership asked about Meta spending or spend for a specific vendor, Glenn simply logs into Stackpack to find live, updated data that empowers the team to make targeted, data-driven decisions. But the real breakthrough is that Autopilot's founders often don't need to ask Glenn at all. They access Stackpack directly, and because it's so easy to view spend, they query data more frequently — keeping a constant pulse on finances without interrupting Glenn's workflow.

Second, generating comprehensive vendor lists for monthly reporting with up-to-date, accurate reports showing spend by vendor and expense type — data that previously required manual compilation from multiple sources.

Rather than replacing existing systems, Stackpack filled the exact gap in Autopilot's financial stack — connecting siloed vendor data and turning fragmented payments into actionable insights. For Glenn, as a fractional controller in a hypergrowth environment, this meant reduced operational overhead, reliable numbers for financial oversight, and hours reclaimed for strategic finance work.

“We can just log into Stackpack and all the vendor spend data is live and updated, which saves us over 200 hours annually. It brings it all together in one place.”

The Outcome

Autopilot Replaces Manual Vendor Spend Tracking with Real-Time Financial Intelligence and Sees a 4x ROI

Stackpack transformed Autopilot's vendor management from spending 20+ hours a month of spreadsheet forensics into instant, actionable intelligence - delivering better financial governance and freeing capacity for strategic growth. The impact extended beyond time savings, fundamentally improving how Autopilot's lean team controls expenses and makes financial decisions at hypergrowth speed.

- 200+ hours saved annually on vendor reporting

- $35,000 worth of finance hours reclaimed each year

- 4x annual ROI, with each dollar delivering $4 in finance time savings

As Autopilot continues to pursue growth goals, Stackpack and Autopilot are extending their collaboration to focus on marketing spend visibility. The next phase includes integrating Stackpack’s AI assistant, which will surface spend patterns and highlight trends across marketing vendors - giving leadership deeper, real-time insight into where budgets are going and how they’re shifting over time.

What would your team do with 200 extra hours? Let’s find out.

Discover how teams like Autopilot save 200+ hours and reclaim $35K+ in value. Book your demo today.